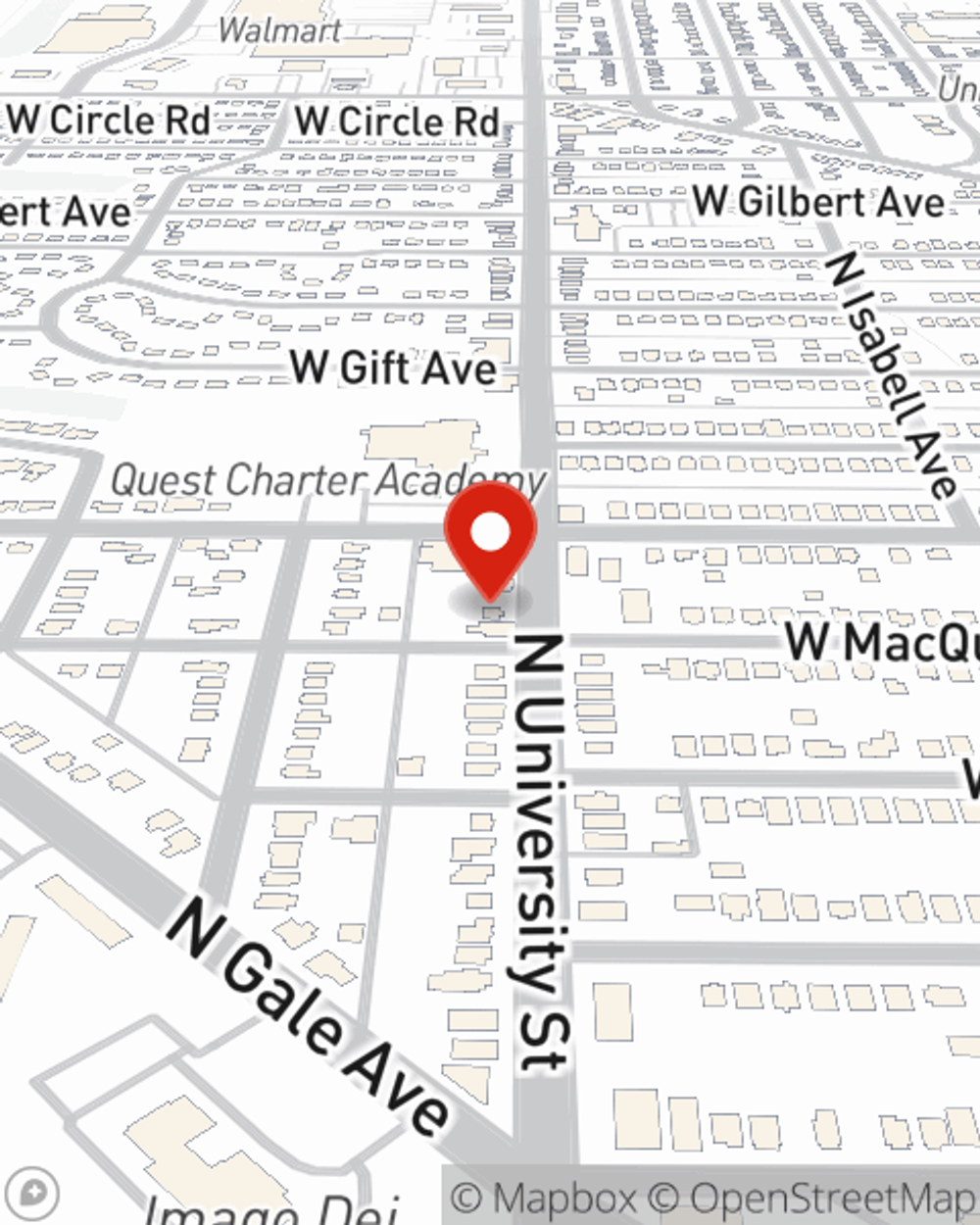

Homeowners Insurance in and around Peoria

Protect what's important from the unexpected.

Help cover your home

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Home is where love resides friends always belong, and you're insured by State Farm. It just makes sense.

Protect what's important from the unexpected.

Help cover your home

Why Homeowners In Peoria Choose State Farm

State Farm's homeowners insurance secures your home and your memorabilia. Agent Jerry Ivie is here to help build a policy with your specific needs in mind.

Having remarkable homeowners insurance can be significant to have for when the unexpected happens. Call or email agent Jerry Ivie's office today to figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Jerry at (309) 222-8144 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.

Safety tips for food spoilage

Safety tips for food spoilage

Whether you’re experiencing a power outage or left some food out for a while, here are some safety tips to help avoid consuming spoiled food.

Simple Insights®

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.

Safety tips for food spoilage

Safety tips for food spoilage

Whether you’re experiencing a power outage or left some food out for a while, here are some safety tips to help avoid consuming spoiled food.